Chase Bank Glitch: What Happened, How It Affected Customers, and What Comes Next

Introduction: chase bank glitch

chase bank glitch Have you ever checked your bank account only to find an unexpected error? Imagine that happening on a massive scale! That’s exactly what happened with Chase Bank recently. This wasn’t just a minor hiccup; it was a glitch that left millions of Chase customers confused and, in many cases, panicking over their finances. But what caused this glitch, and how did it affect Chase’s customers? In this deep dive, we’ll explore the ins and outs of the Chase Bank glitch, understand its broader impacts, and discuss what it means for the future of digital banking.

Understanding the Chase Bank Glitch: What Went Wrong?

A Technical Breakdown of the Issue

Banks today operate through complex digital systems, handling millions of transactions per day with state-of-the-art technology. But even the best technology can sometimes fail, and when it does, the results can be chaotic. In the case of Chase, the glitch stemmed from a technical error in their transaction processing system. This error caused certain transactions to either be duplicated or completely wiped out, leading to an unusual fluctuation in customer account balances.

For customers, this meant a range of issues—some found duplicate charges on their accounts, while others saw charges disappear, creating a surplus or deficit that wasn’t accurate. Chase Bank’s reliance on automated systems, while generally reliable, has now highlighted the potential risks associated with digital-only banking models.

Chase Bank’s Initial Response to the Glitch

As soon as the glitch was detected, Chase’s technical team jumped into action, aiming to contain the issue as quickly as possible. They notified customers through social media platforms, urging them to avoid any major transactions until the error was resolved. Despite these efforts, many customers continued to experience issues, with the system glitch still affecting their accounts even hours later.

From a customer perspective, this response was seen as less than ideal. Many felt that Chase could have been more transparent and provided more frequent updates on the resolution process. This experience raised questions about Chase’s customer service capabilities and the bank’s readiness for unexpected issues in their systems.

The Role of Cybersecurity and System Maintenance

One of the big questions surrounding the Chase glitch was whether cybersecurity played a role in the system error. While Chase was quick to assure customers that there was no data breach, the incident did lead to concerns about the robustness of Chase’s system maintenance protocols. In a world where cyber-attacks are increasingly common, customers are rightfully cautious about the safety of their financial information.

Experts suggest that while the glitch might have been purely technical, it underscores the need for regular and thorough system checks to prevent future issues. It also raises a conversation about the role of real-time system monitoring and how banks can work to safeguard customer data even when technical issues arise.

How the Glitch Affected Chase Bank Customers

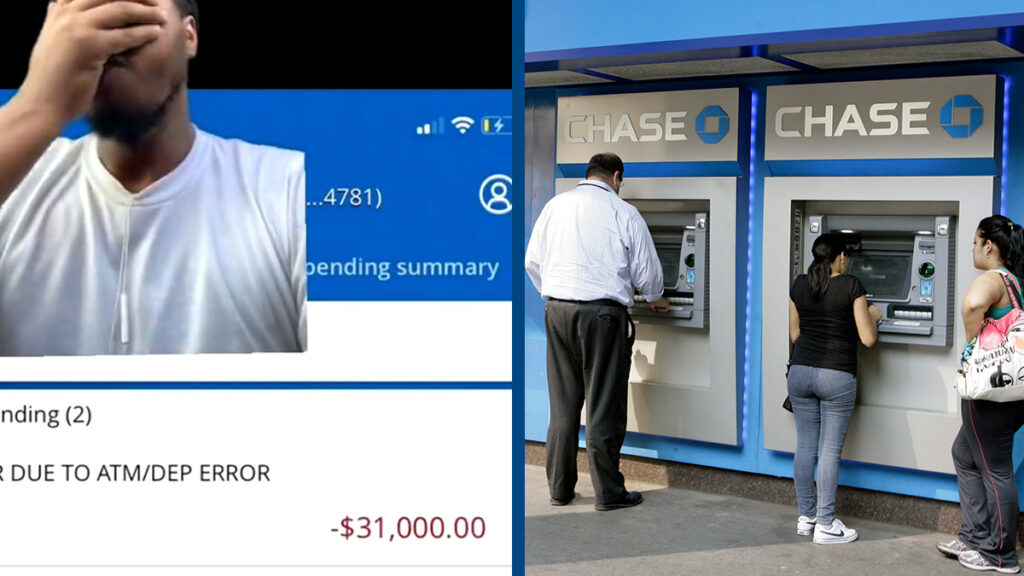

A Financial Nightmare: The Immediate Impact on Accounts

For most customers, discovering discrepancies in their bank accounts led to immediate concern. Imagine logging in to see your account balance significantly altered, with missing or extra charges you couldn’t account for. Some customers even chase bank glitch saw direct deposits delayed, which affected their ability to pay bills and meet financial obligations on time.

The stress caused by these inconsistencies was overwhelming for many Chase customers, especially those with time-sensitive financial needs. For instance, individuals relying on paycheck deposits found themselves in a bind, unable to access their money when they needed it the most.

Overdraft Fees and Other Complications

A particularly frustrating aspect of the Chase glitch was the wave of overdraft fees it triggered. As balances were adjusted unexpectedly, many customers were left with negative balances, which automatically triggered overdraft fees. chase bank glitch Chase assured customers they would waive these fees, but for many, it became a tedious process to sort out.

Beyond overdraft fees, some customers also faced complications with scheduled bill payments and direct debits, which were declined due to insufficient funds. This added yet another layer of inconvenience, as customers had to manually resolve these payment issues while waiting for Chase to restore their correct balances.

Customer Trust and the Reputational Impact

Trust is foundational in the banking sector, and any disruption—especially one that directly impacts customer funds—can erode that trust. For many customers, the Chase glitch served as a wake-up call about the vulnerabilities of digital banking systems. While glitches are relatively rare, this incident made it clear that no system is foolproof.

The glitch not only hurt Chase’s reputation but also forced customers to consider other options. When banking reliability is compromised, it’s chase bank glitch natural for customers to explore more stable alternatives. While Chase has a solid reputation, this glitch was a stark reminder of how quickly trust can waver when finances are involved.

Chase’s Response and Resolution Efforts

Damage Control and Customer Communication

Once the scale of the glitch became apparent, Chase focused heavily on damage control, reaching out to affected customers with reassurance that their money was safe and that any fees incurred would be reversed. However, despite these efforts, many customers felt that Chase’s communication could have been more proactive and detailed.

Chase used email notifications and social media to keep customers informed, but this wasn’t enough to quell the widespread concerns. chase bank glitch For instance, customers wanted real-time updates, but many found Chase’s responses vague or too general to address their specific concerns. This reaction highlighted the importance of clear, effective communication in times of crisis.

Compensating Customers: Fee Waivers and Other Remedies

Understanding the frustration that customers faced, Chase quickly announced that all overdraft fees triggered by the glitch would be waived. They also committed to reversing any penalty charges or late fees caused by the glitch. In some cases, chase bank glitch Chase offered additional compensation to high-impact customers who experienced significant financial disruptions.

However, the compensation process wasn’t entirely seamless. Some customers found it challenging to navigate the claim process or to confirm if their fees had been correctly reversed. While Chase made efforts to compensate affected individuals, this part of the process underscored the need for a more streamlined approach to post-incident resolutions.

Lessons Learned: How Chase Plans to Prevent Future Issues

Chase acknowledged that the glitch chase bank glitch was a learning experience, and they pledged to implement additional safeguards. The bank reportedly invested in system upgrades and increased its focus on real-time monitoring tools to detect issues before they impact customers.

The incident has also led Chase to reevaluate its crisis response strategy. Moving forward, the bank plans to improve its communication protocols, ensuring customers receive timely updates and transparent information during future incidents. chase bank glitch While the glitch was a setback, it has driven Chase to adopt measures that, ideally, will enhance system reliability in the long term.

The Broader Implications for Digital Banking

Are Digital Banks at Greater Risk?

As the world moves towards a digital-first approach, the recent glitch at Chase raises a critical question: Are digital banks more prone to such issues? Unlike traditional banking systems, which often have multiple redundancies, digital banking relies on automated processes that, while efficient, can magnify errors.

Digital banks, including Chase’s online platform, are designed for convenience and speed, but this convenience comes with risks. chase bank glitch Automated systems reduce human error but can amplify technical errors, as seen in this glitch. The incident suggests that digital banks may need to rethink their approach to system checks and balances.

Regulatory Response and Industry Standards

The glitch at Chase has also drawn the attention of regulators, who are keen to prevent such disruptions from happening again. Banking chase bank glitch regulators are now more focused on ensuring that banks, particularly those heavily invested in digital systems, maintain high standards of security and stability.

Industry experts are calling for more rigorous standards for system monitoring, particularly for banks with millions of users. Regulators may impose additional compliance measures on digital banks, requiring them to perform more frequent testing and to provide backup support for customers affected by unexpected disruptions.

What This Means for Chase Customers and the Future of Banking

For Chase customers, the glitch was a clear indication of both the advantages and pitfalls of digital banking. While Chase Bank has taken steps to address the issue, the event has created a sense of wariness among customers about depending chase bank glitch entirely on digital systems. Moving forward, customers are likely to expect higher standards of transparency and reliability from banks.

As digital banking becomes the chase bank glitch norm, both customers and banks will have to adapt to the risks associated with new technologies. The Chase glitch, while an unfortunate incident, has sparked an important conversation about the future of digital banking and the need for robust safeguards that can protect customer data and funds from unexpected issues.

How to Safeguard Your Finances in an Era of Digital Banking

Monitor Your Accounts Regularly

One of the best ways to protect chase bank glitch your finances is to monitor your accounts frequently. With digital banking, you can access your account details anytime, making it easier to spot any unusual activity. Many banks, including Chase, offer alerts that notify you of suspicious transactions. Setting up these alerts can help you catch errors early, especially during times of technical issues.

Checking your accounts regularly isn’t chase bank glitch just about preventing fraud; it’s also a way to ensure that any potential bank glitches don’t go unnoticed. For example, if you had been monitoring your account closely during the Chase glitch, you could have spotted discrepancies early and reached out for assistance promptly.

Diversify Your Banking Methods

Another safeguard is to diversify your chase bank glitch banking methods. While digital banking is convenient, relying on multiple methods, such as cash or credit cards, provides a fallback option if technical issues occur. In the event of a glitch, having access to alternative funds can ease the stress and prevent you from being stranded without money.

Consider keeping an emergency fund in a separate account that isn’t tied to your primary bank. This approach gives you access to backup funds in case of disruptions. The Chase glitch highlighted how having multiple banking options chase bank glitch can be helpful when one system encounters an issue.

Keep Important Banking Contacts Handy

When glitches happen, contacting your bank’s support line becomes a priority. Keep

Post Comment